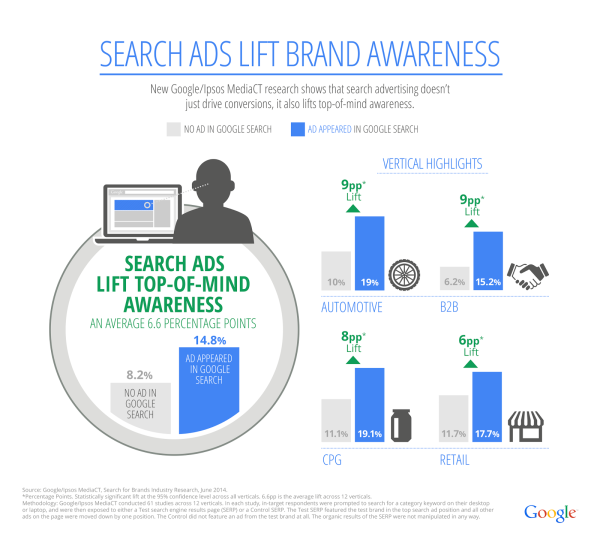

Google announced the results of an interesting study this week that proclaims “Search Ads Lift Brand Awareness“. By the title of the announcement alone, it sounds like a promising reason to invest more in AdWords campaigns for your business, too bad the information is slightly misleading.

Don’t get me wrong, pay-per-click search ads can be absolutely beneficial for a business. But, it is troubling when a group misrepresents their findings to a more positive spin when it clearly benefits their own business.

Ginny Marvin was one of the first to point out the misleading nature of the Google report, and sums up the issue quite well by offering the alternate title “The Top Search Ad Lifts Brand Awareness”.

The Google meta-study reviewed several studies conducted by Google and Ipsos MediaCT across a set of verticles including CPG and automotive. A total of 800 consumers were asked to search for a category specific keyword. Across those searches, the results showed that the test brands saw increases in awareness across all verticles.

When respondents were asked what brand first came to mind when thinking about a specific category keyword, an average of 14.8% in the Test group named the test brand, while just 8.2% of the Control group named the same brand. That’s a 6.6 percentage point increase or an average 80% lift in top-of-mind awareness.

That is all well and good, but the problem is Google only tested the brand impact for brand’s appearing in the top spot. None of the other ad positions were evaluated at all.

The Test SERP featured the test brand in the top search ad position, with all other ads on the page moved down by one position. The Control did not feature an ad from the test brand at all. The organic results of the SERP were not manipulated in any way.

Marvin is much more precise with her deconstruction of the flaw in Google’s study, but simply put: all ad spots are not made equal. In fact, like ranking positions, ad spots are highly inequal. The ads in the second and third positions are likely to experience in awareness, but the nature of the study makes that impossible to verify. Almost certainly, any awareness lift they see is modest compared to that found in the first position.

In the end, Google’s recommendations based on their findings are probably still solid and no online marketer will argue about the value of branded paid advertising. Still, Google should be more careful with their words next time. Intentional or not, misrepresenting findings never looks good.