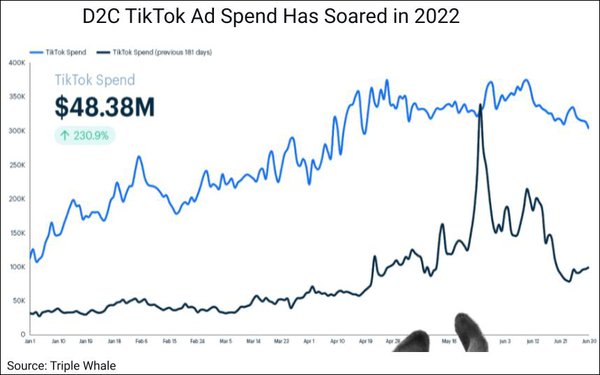

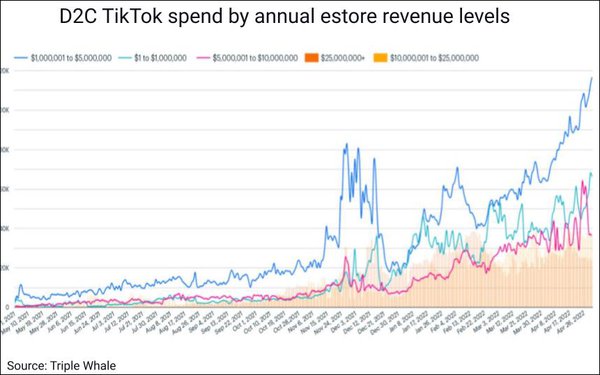

TikTok continues to gain more interest from brands – especially ecommerce brands – as it proves that the social app is here to stay. New data collected from over 5,000 stores shows that ecommerce brands spent 60% more to advertise on TikTok in Q2 of 2022. Even more, analysts believe the trend will continue for the foreseeable future.

This information comes from Triple Whale ecommerce analytics, which gathered the data from all the stores using their tools to estimate the overall growth of ecommerce ad spend on the increasingly popular social video app.

“It’s time to get on TikTok while the needle’s still moving in the upward direction, or before users are completely inundated with ads from new brands,” advises Triple Whale. TikTok “is no longer a channel serious paid media buyers can avoid without cutting into revenue and profit.”

Other Findings About Ecommerce Q2 TikTok Ad Spend

Notably, the most significant increases don’t come from major brands. Smaller retailers with annual sales between $1 million and-$5 million are instead leading the charge.

Along with these findings, the report also included a few other interesting facts:

- Overall ad spend across the 5,000 online retailers rose by 11% in Q2 to a total of $529.7 million

- Retailers with revenues between $1 million and $5 million are contributing to the biggest increases in ad spend

- In the first two quarters of this year, retailers spent a total of $48.4 million on TikTok ads – which was a 231% increase over the previous 6 months

- CPMs vary by industry. Baby, books and collectibles niches have a CPM below $10, while health & beauty & digital products are over $14 CPM

- Stores with over $25 million in sales have the highest average order values and ROI

How TikTok Compares To The Competition

While TikTok is showing impressive growth in popularity among online retailers, it still trails Facebook and Google by a significant amount. Specifically:

- Despite only growing 5.6% from Q1, Facebook remains the leading ecommerce choice for advertisers by a wide margin

- Google grew 20.5% in Q2

- Snap declined 10.8% in Q2

If you’ve been writing off TikTok as just another social network that will be here today and gone tomorrow, it is likely time to reconsider. The platform seems to be cementing its place among users and winning over brands through increased ad revenue.