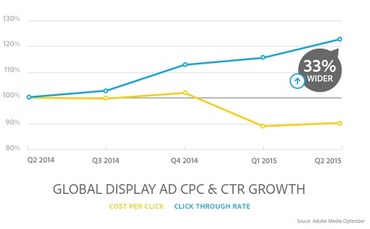

While display cost-per-click (CPC) growth is steadily falling, Adobe’s new Digital Advertising Report shows the opposite is happening on smartphones.

Using aggregated, anonymized data gathered over the past three years, Adobe assessed over 489 billion digital ad impressions. According to the data, click-through-rate (CTR) growth is consistently rising, but CPC growth how hit a steep decline over the past year, especially between Q4 and Q1. At this point, there is a 33-point gap between CTR growth and CPC growth, despite the two being nearly equal at this time last year.

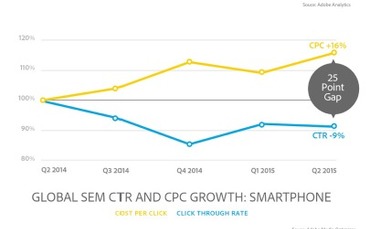

However, smartphones seem to be bucking the trend. Mobile CPC growth is up 16 percent while CTR shows a 9 percent decrease year-over-year, leading to a 25-point gap. Adobe’s team believes the so-called “mobilegeddon” is largely responsible for the spike in mobile paid search.

The team also said price is another favor facilitating the increase in CPC growth on smartphones. According to Tamara Gaffney, principal analyst for Adobe Digital Index, clicks on mobile are cheaper than desktop clicks, but the trend is unlikely to stick around.

“Mobile advertising’s lack of perceived value causes a mobile search click to be worth 37 percent less than a desktop search click,” she says. “Conservative and incremental approaches to tackle ‘mobile stress’ are insufficient to bridge the gap. Disruptive and innovative changes will be required in order to drive future business success on both the publisher and marketer side.”

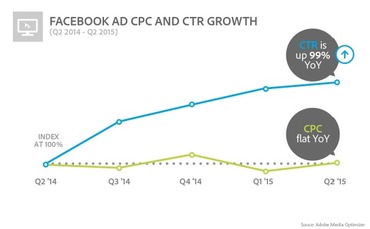

Facebook also saw a 23 percent increase in clicks, despite showing half the impressions year-over-year. The social platform’s CPC has largely stayed stagnant, but CTR growth has shot up 99 percent YoY.

Adobe says Facebook’s huge increase is the result of improved targeting on the platform, with 51 percent of U.S. consumers saying they believe Facebook ads are genuinely of interest, compared to just 17 percent of consumers on YouTube. Gaffney also said Facebook has decreased the overall number of ads it shows users to create a better balance for users on mobile screens.

“[Google is] starting to lose ground as a marketing vehicle and part of the reason why is because they aren’t getting as many clicks out of global display ads,” Gaffney says.

Google has dominated the search market for years, but the latest findings show they are slowly losing ground. Google still holds 65 percent of the global search spend share, and 61 percent in North America, but Yahoo and Bing’s combined efforts is gradually rising 4 percent year-over-year.