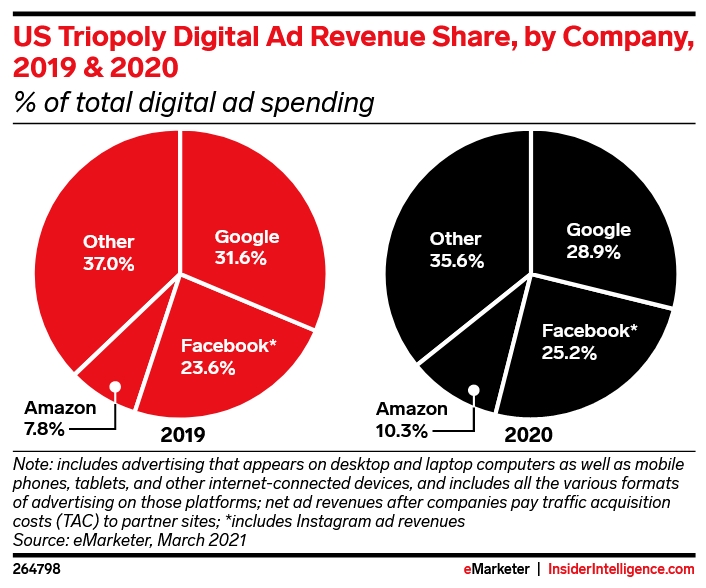

For years, two names have ruled the online ad game – Google and Facebook. Currently, that is still true, though a new analysis suggests Amazon is steadily expanding its ad business to be a sizable challenger to the Big Two.

Research firm eMarketer’s latest annual digital ad report shows that Amazon’s share of digital ad revenue broke two digits in 2020, earning 10.3% of U.S. online ad revenue. That’s a significant jump from 7.8% in 2019.

In actual dollars, the online retail giant’s ad revenue reached $15.73 billion, an increase of more than 50% from the previous year.

Should Facebook and Google Be Worried?

Amazon still has some ways to go before it’s ad platform is the size of Google or Facebook’s – both of which receive more than 20% of U.S. digital ad spend.

Still, eMarketer predicts the company will continue to increase its share of online ad revenue over the next few years until it is on par with the other two giants.

For Facebook, this might not be a big concern since much of Amazon’s advertising is driven by Amazon Prime video advertising and product ads. In their current form, both platform’s ads largely serve different purposes.

Google, on the other hand, might be getting a little nervous. Over the past few years, the search engine has been investing heavily into its online shopping services, as well as expanding YouTube’s advertising platform.

What Does This Mean For Brands?

Though this might have significant implications for the future of online advertising, nothing has really changed for the majority of brands who might use these platforms for their ads.

However, it does serve as a reminder that there are more than just the Big Two online ad platforms. Many of the others out there may be a better fit, provide less competition, and allow you to reach your potential customers at a more ideal time. This is why it is important to know what each has to offer and invest your ad budget into the platform (or platforms) which make the most sense for you.