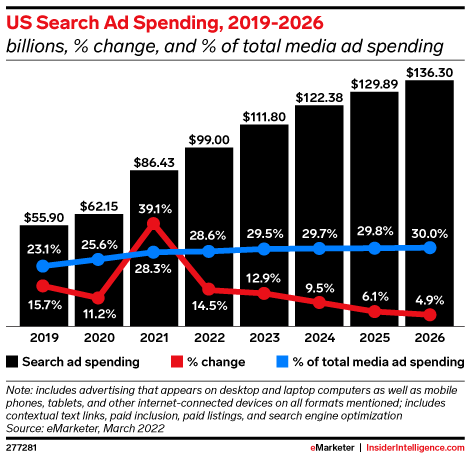

Brands across the US are increasing how much they spend on search advertising, with the overall US search ad spend predicted to reach almost $112 billion by next year. That is nearly double the amount spent in 2019, according to the new report from Insider Intelligence.

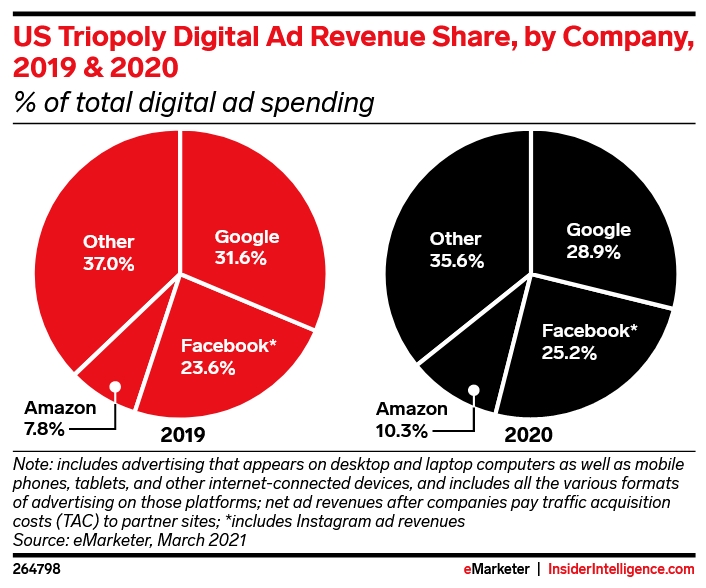

This year, the data says $99 billion is being spent on search advertising. Much of this is driven by Google, which receives about 56% of the total ad spend. Google is in fact driving much of the growth in this area, outpacing all other traditional formats.

While Microsoft remains the second-leading search ad platform, the data indicates that other platforms like Apple and Amazon may eventually overtake it.

Data shows that Apple Search Ads will receive $5 billion dollars alone in 2022 revenue thanks to new ad and placement options which allow brands to find less competitive ad space.

Meanwhile, Amazon is gaining ground as the best platform for bottom-of-funnel customers.

Interestingly, the report indicates that TikTok is also a growing force in search ad spending. The new data shows that up to 40% of 18- to 24-year-olds in the US already prefer to use TikTok and Instagram for their searches instead of Google. This may explain why recent studies showed that brands spent 60% more on overall advertising on the platform.

Mobile Vs. Desktop

Unsurprisingly, mobile search advertising spend is far outpacing desktop by about two-thirds and shows no sign of slowing down.

One indication of this is the fact that more than half of the U.S. population was reported to have used a smartphone to make an online search in 2016. By next year, that number should reach 70% by 2023.

Privacy-Focused Platforms Lose Steam

After years of slow growth, privacy-first platforms like DuckDuckGo appear to be losing traction with US searchers. This is reflected in other recent reports, including data showing that DuckDuckGo had fallen to less than 100 million daily searches in June.

For more findings about the current state of search advertising, download the full report from Insider Intelligence here.